10 years ago, I went to Deer Park Monastery in Escondido, California on a temple stay. At the time, I wasn’t sure if I learned anything. As it turns out, some good seeds were planted.

At lunch we were asked not to speak for the first 30 minutes. It was a time for mindfulness. I watched the monks in their brown robes chewing each bite of food into oblivion with content looks on their faces. Renowned Zen Master Thich Nhat Hanh says “Sometimes your joy is the source of your smile, but sometimes your smile can be the source of your joy.”

For these monks, it looked like the latter case—I mean, who can eat THAT slowly and still be having a good time? My thoughts drifted to one of the elders who had just finished his meal and was pouring some water in his begging bowl to make sure the leftover bits of food would not go uneaten. He swirled it around—it was the perfect bland finish for the bland food we were eating. Needless to say, that temple stay with the monks and nuns of Deer Park was NOT easy for me and it wasn’t something I appreciated until later. Or to be honest, about a month ago.

It reminds me of what Steve Jobs referred to as “Connecting the dots” in a commencement speech he gave at Stanford. I realize now that it was during this temple stay where I learned how to develop what I call “the monk’s tongue” or TMT. More specifically, I realized that natural, unprocessed food has its own flavor without adding spices or salt—without adding butter and all those other culprits that dull the senses.

The secret is easy to understand: make you mouth terrifically bored.

So bored, in fact, that giving it broccoli is like a Chipotle burrito with guac and sour cream and extra cheese! Or cheesecake. Or gummi bears. Or whatever guilty pleasures you taste-buds crave. It takes time. But if I can do it, so can you.

TMT training is turning your taste buds onto natural, unrefined food. Apples turn into delicacies. Chicken breast (boiled) turns into succulent steak (almost). The health benefits are staggering. We all know how unhealthy it is to consume foods high in salt and all that other stuff that makes food taste “good”. Once you reign in those taste buds into some less exciting scenery, you’ll find you are eating healthy and you don’t even miss those Doritos as much as you thought you would. You will redefine what “good” tastes like. How in the world did we start thinking food made in a factory tasted good?

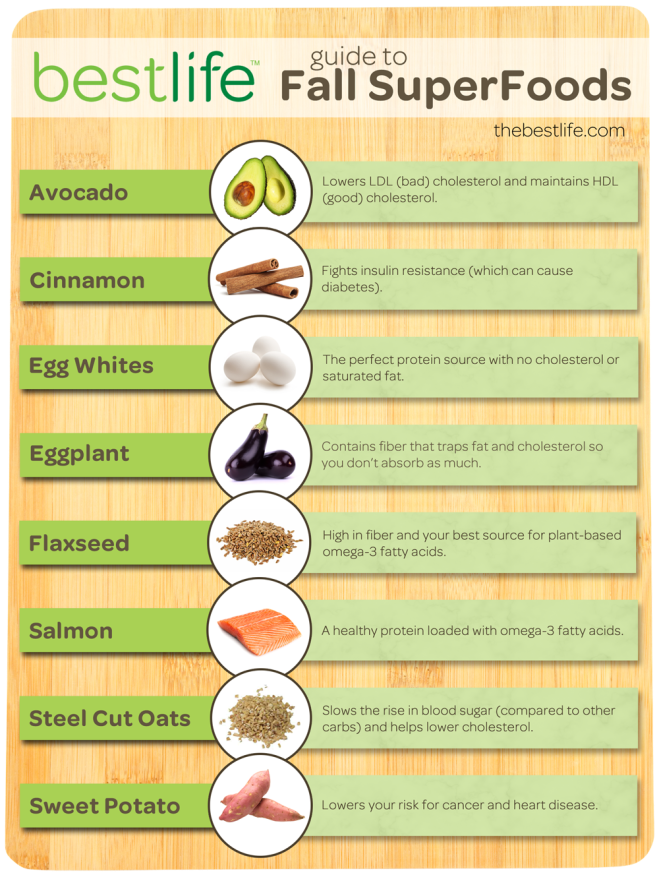

By the way, are you a “foodie”? Be a SUPER FOODIE. Discover quinoa, amaranth, chia seeds, flax seed, kale, acai. Learn that broccoli has chromium—a mineral for enhanced energy. By the way, if you decide to buy some superfoods, go to www.iherb.com (the best place for health foods) and use this code–>PRT779. Save $10 off your order. It will help me too.

Be your own nutritionist. Find out all about the properties of super-foods and then think about your body and your own psychological and physiological needs. Be aware and listen to your body.

These activities I mentioned in the last two paragraphs will keep you going while you develop your monk’s tongue. And once you do that, your boring tongue will lead you all the way to a healthy diet and healthy life. Dull down those taste-buds. It’ll be the best diet advice you get today.